Is Gold the next great trade? We been drawn in before, but, today, gold is making a higher high as the banking dilemma unfolds.

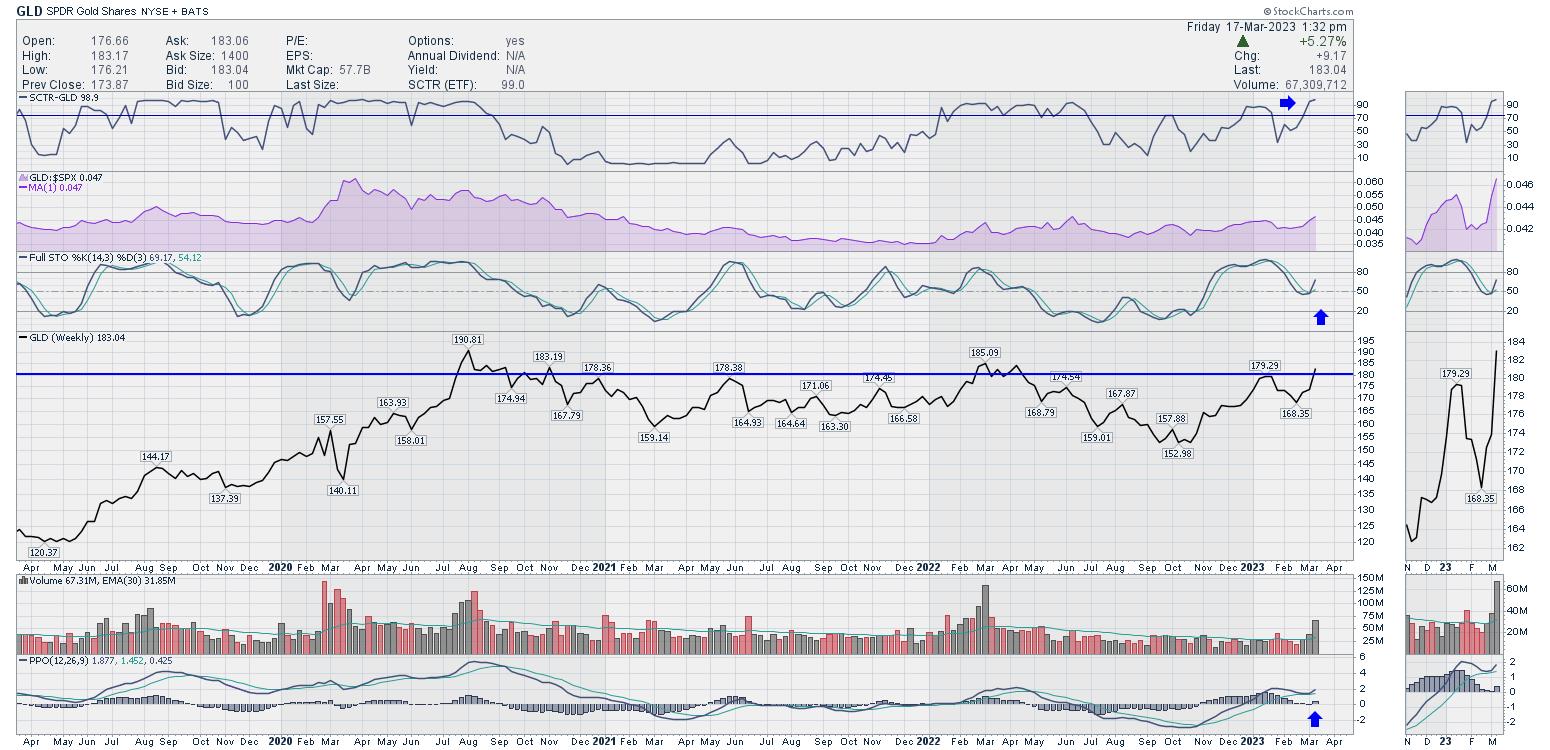

Gold has pulled back since the beginning of February and bottomed out last week. The chart has been making some aggressive moves higher; while they look huge, on a percentage basis, GLD is up about 9%, including the 2% move on Friday.

I think the broader picture on Gold is coming into play. Let’s look at the weekly chart.

- The SCTR is surging to its highest level on the chart!

- Relative strength in purple is turning up.

- Full stochastic is giving a bounce at the 50% level, which is a typical bull market bounce location.

- Price is threatening to break out to new 52 week highs.

- Volume is accelerating on the breakout.

- PPO is turning up while above zero. Another bullish clue!

The real question now is, can Gold continue?

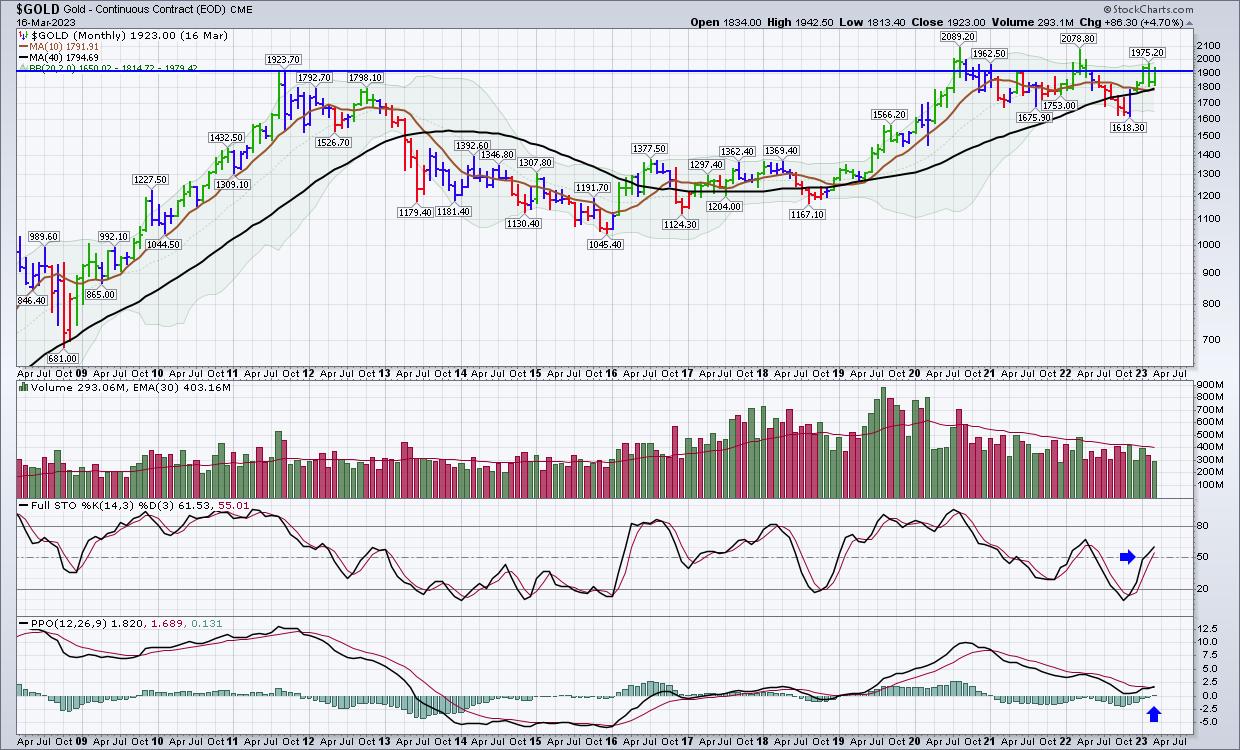

This looks like a nice setup for a continuation move higher. On the monthly chart, it looks nice as well.

- Price is moving back above the 2008 high with a nice thrust. We have tested this level for the last three months.

- I would like to see the volume improve.

- The full stochastic is turning up above 50 for the first time since the spring of 2022. Is this just coming to the end of its seasonal strong period?

- I like the PPO crossing the signal line on the monthly chart. This is the first positive cross since 2019. We’ll need to wait for month end to confirm it.

It’s all set up for a run. Keep an eye on Gold, in my opinion.