Racing ahead of the semiconductor pack, Nvidia (NVDA) appears to be edging toward the upper regions of a parabolic curve.

What Does This Mean for NVDA Stock Price?

It’s a sign of confidence coming off a strong Q4 2022 earnings performance on top and bottom lines. NVDA surprised Wall Street, beating analyst EPS estimates by 8.53% (the largest since the first quarter of 2021).

We’ll address the “parabolic curve” part a little later.

What’s Driving NVDA Stock Ahead of the Pack?

In short, investors see NVDA as a company that’s well-positioned to endure an economic downturn. We can say the same thing about semiconductor stocks in general, but what NVDA has going for it is its central business, which includes the production of AI chips.

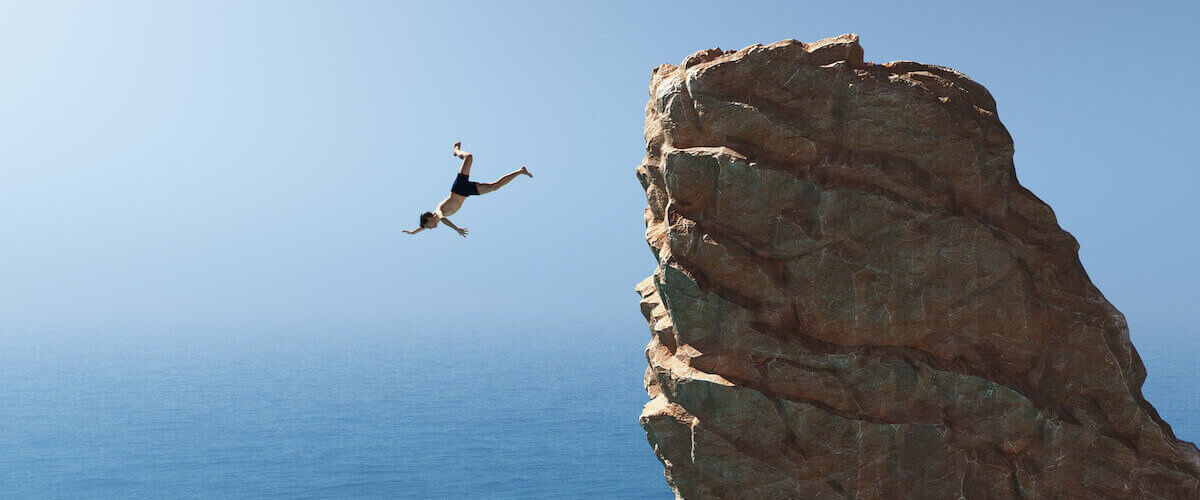

Consider ChatGPT and Microsoft Bing’s AI chatbot. NVDA’s chips have a tremendous capacity to power machine learning software. And if you compare NVDA’s performance against the other top US chip stocks by market cap on PerfCharts, the picture’s pretty clear.

CHART 1: SEMICONDUCTOR SECTOR PERFORMANCE. NVDA broke ahead of the pack starting in mid-January.Chart source: StockCharts.com. For educational purposes only.

If you had checked the StockCharts Technical Rank, comparing NVDA to its sector performance via VanEck Semiconductor ETF (SMH), the difference wouldn’t have been as clear, which is why pairing the two indicators proved important in this case.

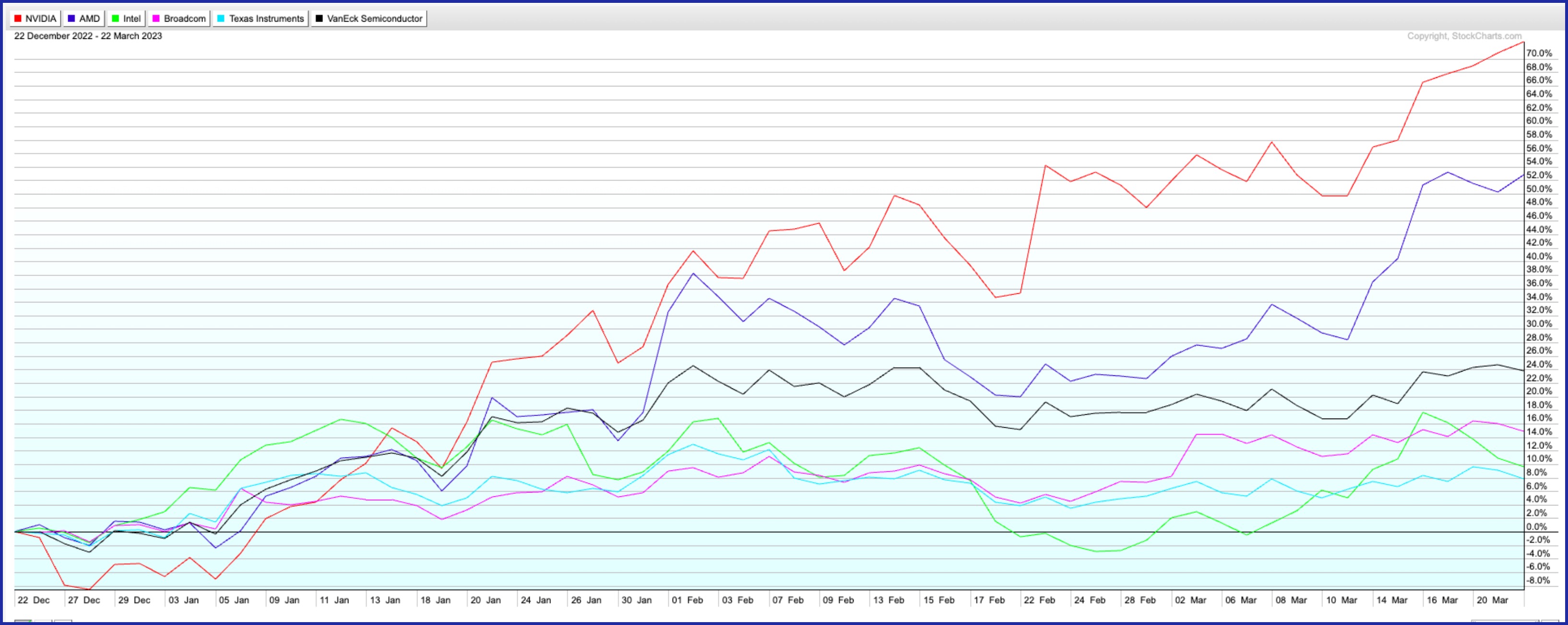

CHART 2: COMPARING SCTR FOR NVDA AND SMH. NVDA’s price and technical performance advanced ahead of SMH in mid-January as seen in the SCTR. With both assets advancing (remember that NVDA is SMH’s largest holding), PerfCharts provided a much clearer picture.Chart source: StockCharts.com. For educational purposes only.

Should Investors Buy into NVDA Strength?

Here’s where investors who are interested in timing their trades tend to get a bit wobbly, especially if fundamental data is the only thing they rely on. And, by the way, when investors hear market pundits on financial media say things like “wait for the dip,” unless investors have a relatively decent grasp of technicals, “the dip” can be virtually anywhere (which isn’t helpful at all).

In this case, I’d be careful.

CHART 3: NVDA’S STOCK PRICE IS SKYROCKETING. How long can it sustain itself? There’s a potential resistance level at $289.46, and there are divergences between price and the MACD and Chaikin Money Flow indicators. The stochastics are in overbought territory.Chart source: StockCharts.com. For educational purposes only.

- Trajectory: Take a look at NVDA’s projected trendline (blue trendline) versus its current parabolic trajectory. It’s skyrocketing, and, typically, movements like this one can sustain themselves for too long.

- Resistance: Next, there’s a strong resistance level near 289.46 (one-year high). Bullish sentiment may be strong leading up to this level, but, given the vertical distance price has traveled from its October low and its January pullback, bullish conviction is likely to be tested at these heights.

- Divergence: NVDA prices may have been advancing sharply, but watch out for divergences in the MACD and the Chaikin Money Flow indicators, both of which paint the picture of decreasing conviction or buying pressure despite NVDA’s skyrocketing price move. Plus, the stochastic oscillator, which also shows a slight divergence, shows that price is well within the “overbought” range.

So, Do You Buy the Dip (Once It Declines)?

The fundamental case for buying shares of NVDA (or SMH, for that matter) is a reasonable one. After all, chip demand tends to weather most economic downturns. But given resistance overhead and the divergence readings that signal a decline in buying pressure from a potentially overbought range, NVDA seems bound for a dip.

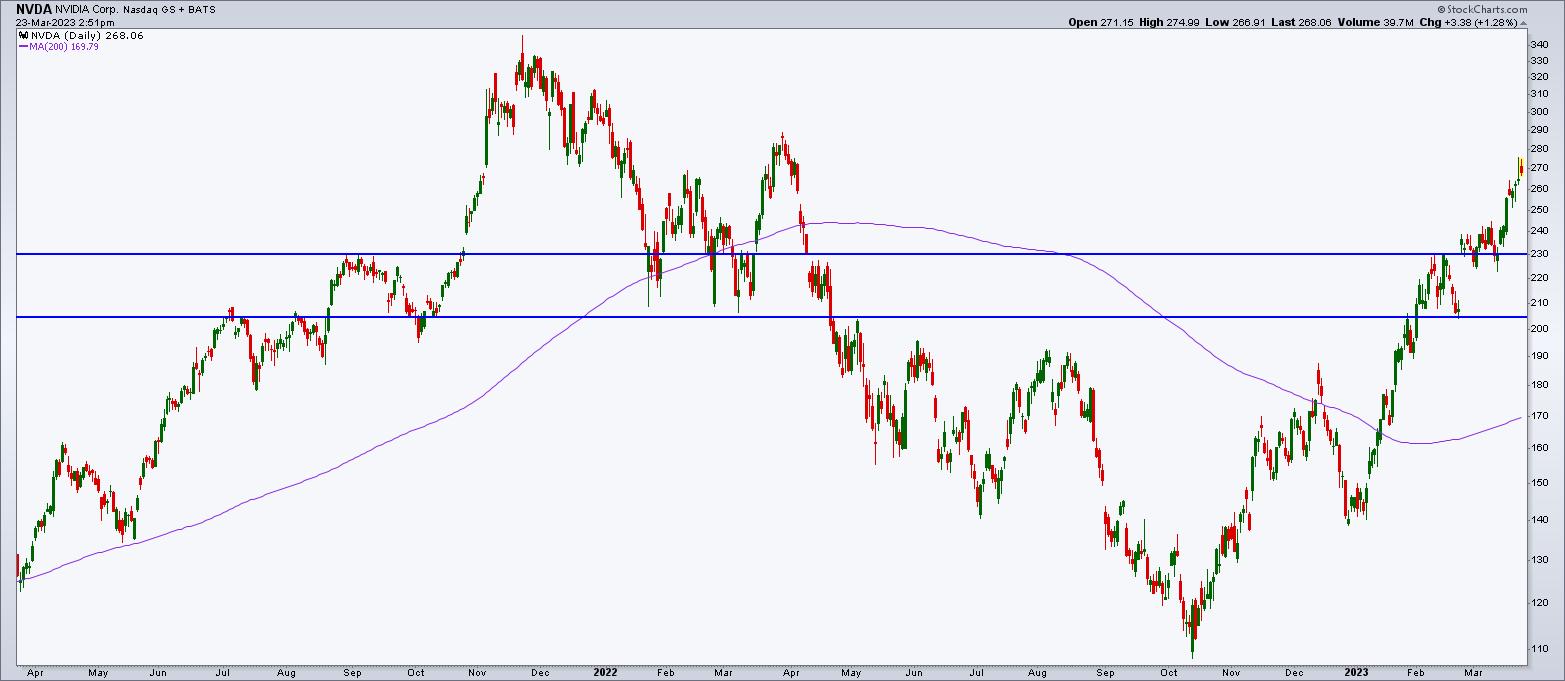

Targeting the range between 205.00 and 230.00 as a potential “buy the dip” level would capture multiple areas of historical support and resistance. There are plenty of other entry points, of course, and some, like Fibonacci retracement levels, are contingent upon a temporary reversal.

CHART 4: WHERE WOULD A POTENTIAL DIP BE FOR NVDA STOCK? The range between $205 and $230 could be a “buy the dip” level, given support and resistance levels from past price data.Chart source: StockCharts.com. For educational purposes only.

NVDA stock is worth adding to your ChartLists. Click on the price charts to see the live version. From there, you can easily add the chart to any of your ChartLists.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation or without consulting a financial professional.